credit card payments

1.1 General information about card payments

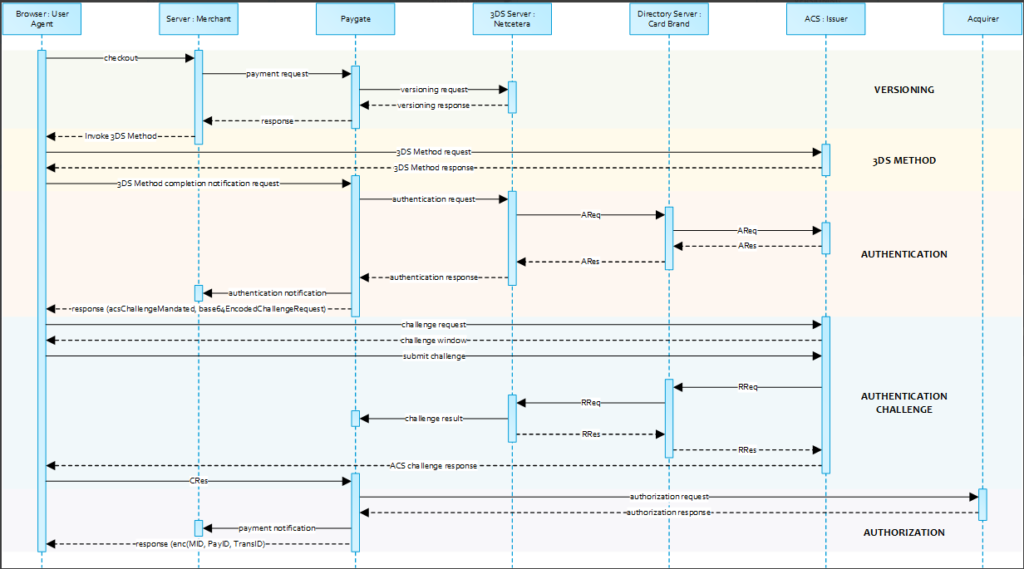

1.2 Process of 3D Secure payments

1.2.1 Process of a transaction with 3D Secure via form interface

1.2.2 Process of a transaction with 3D Secure via Server-to-Server-connection

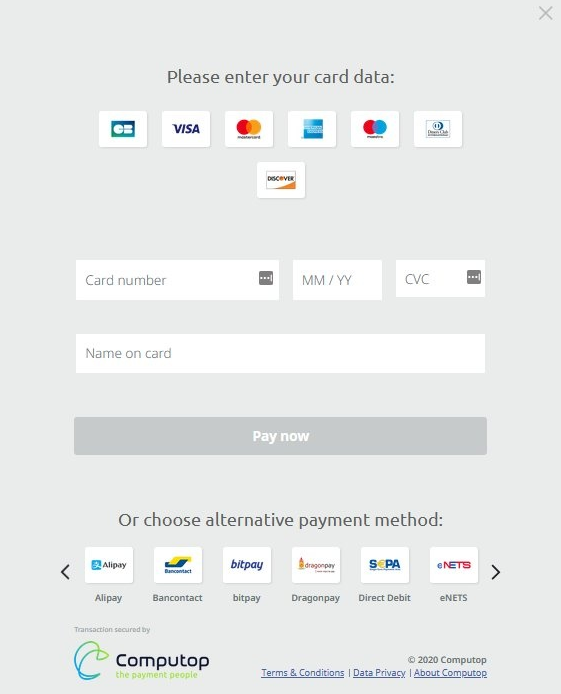

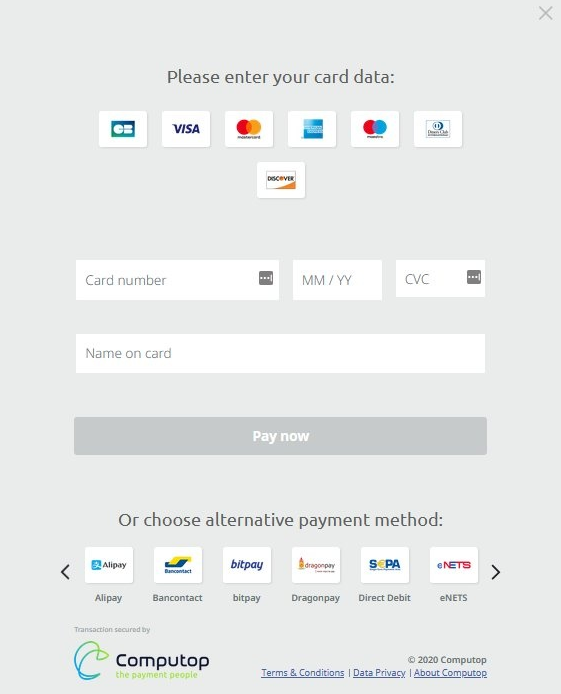

2 Card processing – common form

2.1 Card processing – Credit Card Form

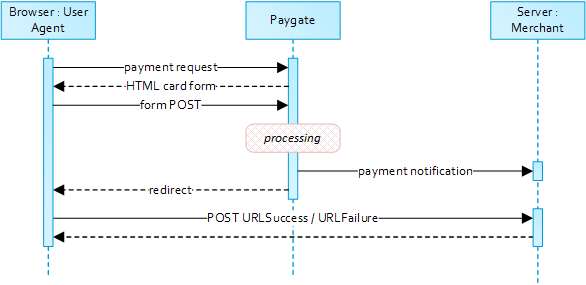

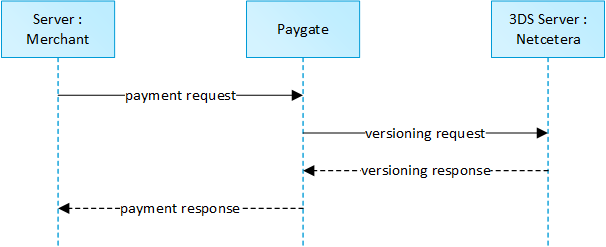

2.1.1 Simplified Sequence Diagram

2.1.3 HTTP POST to URLSuccess / URLFailure / URLNotify

2.1.4 Credit card payments with separate authorisation

2.1.5 Extended Sequence Diagram

2.2.8 Link to Visa Secure and MasterCard Secure Code

2.2.9 Programming and testing the form

3.1 Card processing – Server-2-Server integration

3.4 Call of interface: general parameters

3.4.2 Response Elements (authentication)

3.5.1 3-D Secure Method: threeDSMethodURL

3.5.2 3-D Secure Method: No issuer threeDSMethodURL

3.5.3 3-D Secure Method Form Post

3.5.5 3-D Secure Method Notification Form

3.6.1 Cardholder Challenge: Browser Response

3.6.2 Browser Challenge Response

3.6.3 Authentication Notification

3.7.2 Browser Payment Response

4.5 Reversal of an authorization extension

4.6 Credit card payment via POS terminals

4.7 Reversal of POS credit card payments

5.1 Silent Mode for credit cards with SSL and 3D Secure method

6 Batch processing via the interface

6.2 Cancel authorization renewals

7.1.1 Acquirers and connection

7.1.2 Integration with the 1cs OPS

1. About card payments

1.1 General information about card payments

First Cash Solution’s the 1cs Online Payment System processes all major cards and currencies worldwide. Card data is protected against unauthorised access by TLS encryption. Additional security functions are integrated fraud prevention and risk management. Our standardized settlement files guarantee a straightforward reconciliation processes in your accounting.

Visa Secure and MasterCard SecureCode secure your payment claim by password validation if a customer disputes the payment later. American Express SafeKey also uses the 3-D Secure technology, which means that the card holder must confirm their identity with a password.

Transaction processing can be made via the 1cs Online Payment System standard form, via customized forms, via server-to-server-connection or via batch transfer. Likewise the 1cs Online Payment System can process transactions from stationary terminals.

Using the card form provides several advantages:

- Merchants can bypass the costly PCI-security authorisation

- The programming of 3-D Secure with forms is much easier and quicker than via Server-to-Server connection

| Info | Type |

| The 1cs Online Payment System processes all major cards and currencies worldwide. Transaction processing can be made via 1cs Online Payment System standard form, via customized forms, via server-to-server-connection or via batch transfer. Likewise the 1cs Online Payment System can process transactions from stationary terminals. | Payments by Credit Card |

1.2 Process of 3-D Secure payments

MasterCard SecureCode (UCAF), Visa Secure, Diners ProtectBuy, JCB J/Secure and American Express SafeKey are authentication methods which verify the identity of the card holder before making the payment. The name 3-D Secure used by technicians describes only the protocol. The correct brand names are Verified by Visa, MasterCard SecureCode, SafeKey, ProtectBuy and J/Secure.

Merchants benefit from authentication with 3-D Secure because the card schemes provide a liability shift: If you are using Visa Secure, MasterCard SecureCode, Diners ProtectBuy, JCB-Card J/Secure or American Express SafeKey, the burdon of proof and thereby generally the liability is shifted from the merchant to the card issuing bank, should the customer dispute the payment. Irrespective of whether the card holder actually uses the authentication you obtain a very high protection against payment defaults / chargebacks in case the customer states they have not authorised the card payment. Your Acquirer will be able to discuss the details of 3-D Secure and the cover that it provides.

From a technical perspective 3-D Secure is not a payment method but an authentication process which precedes the payment: Once the credit card data has been entered, the 1cs Online Payment System checks the identity of the card holder and does not process the payment until after the authentication.

For further steps it is crucial if the credit card connection is made via form interface or via Server-to-Server-connection. In the first case the 1cs Online Payment System form assumes the further authentication process, with Server-to-Server-connection the merchant has to manage the authentication through a separate interface.

Notice: Please make sure to review our EMV 3D Secure Specification to integrate according to the newest standards.

Notice: Please notice that in case of Fallback to 3-D Secure 1.0 the URLSuccess or URLFailure is called with GET. Therefore your systems should be able to receive parameters both via GET and via POST.

1.2.1 Process of a transaction with 3-D Secure via form interface

When requesting card payments via 1cs Online Payment System hosted forms the complexity of 3-D Secure is completely removed from the merchant implementation.

From a merchant point of view the sequence itself does not differ between 3DS authenticated and non-authenticated payments though 3DS requires consideration of additional data elements in the request and response.

Simplified Sequence Diagram

When requesting card payments via the 1cs Online Payment System hosted forms the complexity of 3-D Secure is completely removed from the merchant implementation.

From a merchant point of view the sequence itself does not differ between 3DS authenticated and non-authenticated payments though 3DS requires consideration of additional data elements in the request and response.

Notice about Cookie-/Session Handling: Please note that some browsers might block necessary cookies when returning to Your shop. Here you will find additional information and different solution approaches.

The 1cs Online Payment System will return an HTML document in the response body representing the requested card form. The form may be included in the merchant checkout page or used as a standalone page to redirect the card holder to.

Card holder authentication and payment authorization will take place once the the cardholder entered all required card details and submitted the form data to the 1cs Online Payment System.

Notice: In case you are using your own templates (Corporate Payment Page), please make sure you include Cardholder name on your custom template. Cardholder name is mapped to Paygate API parameter “CreditCardHolder”. Cardholder name field must not contain any special characters and must have minimal length of 2 characters and maximum length of 45 characters.

When the payment is completed the 1cs Online Payment System will send a notification to the merchant server (i.e. URLNotify) and redirect the browser to the URLSuccess respectively to the URLFailure.

The blowfish encrypted data elements as listed in the following table are transferred via HTTP POST request method to the URLNotify and URLSuccess/URLFailure.

Notice: Please note that the call of URLSuccess or URLFailure takes place with a GET in case of fallback to 3-D Secure 1.0. Therefore your systems should be able to receive parameters both via GET and via POST.

The credit card form can be highly customized by using your own template.

Details are available here: Corporate PayPage and templates

If the password is correct the 1cs Online Payment System obtains confirmation in the form of a signature. Only after confirmation does the 1cs Online Payment System start the payment and send the transaction with the signature to the Acquiring Bank.

Details on the integration can be found here: Credit Card Form (paySSL)

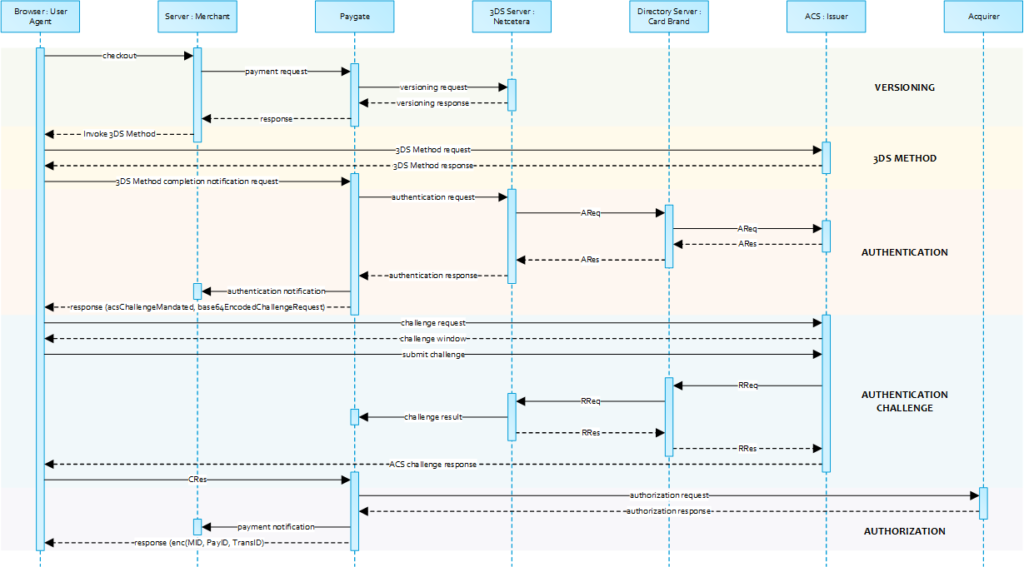

1.2.2 Process of a transaction with 3-D Secure via Server-to-Server-connection

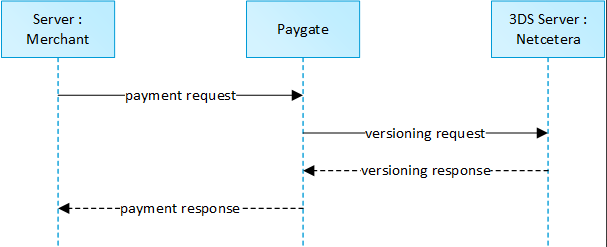

A 3-D Secure 2.0 payment sequence may comprise the following distinct activities:

- Versioning: Request ACS and DS Protocol Version(s) that correspond to card account range as well as an optional 3-D Secure Method URL

- 3-D Secure Method: Connect the cardholder browser to the issuer ACS to obtain additional browser data

- Authentication: Submit authentication request to the issuer ACS

- Challenge: Challenge the card holder if mandated

- Authorization: Authorize the authenticated transaction with the acquirer

Please note that the the communication between client and Access Control Server (ACS) is implemented through iframes. Thus, responses arrive in an HTML subdocument and you may establish correspondent event listeners in your root document.

Alternatively you could solely rely on asynchronous notifications delivered to your backend. In those cases you may have to consider methods such as long polling, SSE or websockets to update the client.

The initial request to the 1cs Online Payment System will be the same regardless of the underlying 3-D Secure Protocol.

In order to start a server-to-server 3-D Secure card payment sequence please post the following key-value-pairs to https://www.computop-paygate.com/ direct.aspx.

| Parameter | Format | CND | Description |

| ACSURL | ans.. | C | Only in the case of registered credit cards: URL of the Access Control Server of the card issuer with attached request parameters (not URL-encoded!). It is possible to use ACS server ampersand and question mark as value within the URL; everything before parameter PAReq is part of ACSURL. |

| PaReq | ans.. | M | Payer Authentication Request, which must be URL-encoded. |

| MD | M | Merchant Data is an empty value, which must be transferred for compatibility reasons | |

| TermURL | ans.. | M | Shop return address. the 1cs Online Payment System adds the parameters PayID, TransID and MID as request parameters to the initial TermURL seperated with a question mark. |

1.3 Credit card brands

1.3.1 Overview of supported card schemes by payment method

Card processing

The 1cs Online Payment System processes all major cards and currencies worldwide. Transaction processing can be made via the 1cs Online Payment System standard form, via customized forms, via server-to-server-connection or via batch transfer. Likewise the 1cs Online Payment System can process transactions from stationary terminals.

| Credit card brand, correct spelling for CCBrand |

| MasterCard |

| VISA |

| AMEX |

| DINERS |

| CBN |

| JCB |

| Dankort |

| Maestro |

| Cartes Bancaires |

| Discover |

| Bancontact |

| Hipercard |

| Elo |

| Aura |

| Carte 4Etoiles |

| AirPlus |

| CUP |

| NARANJA |

| SHOPPING |

| CABAL |

| ARGENCARD |

| CENCOSUD |

| KOOKMIN |

| KEB |

| BC |

| SHINHAN |

| SAMSUNG |

| HYUNDAI |

| LOTTE |

| 1euro |

| echequevacances |

| cofidis3xcb |

| cofidis4xcb |

| facilypay-3x |

| facilypay-3xsansfrais |

| facilypay-4x |

| facilypay-4xsansfrais |

| RuPay |

Bancontact

Bancontact is a Belgian payment method for Debit cards with which the merchant obtains a payment guarantee and eliminates the risk of chargebacks. At the Bancontact checkout customers enter their card details and are then directed to their own online bank where they simply need to authorize the payment they have just made.

| Card Scheme |

| Bancontact |

Be2Bill

Be2bill is specially optimized for the “Cartes Bancaires” credit cards which is widely used in France.

| Card Scheme |

| VISA |

| MasterCard |

| Cartes Bancaires |

Cofidis

The 4-star card is a private card that combines payment facilities and loyalty benefits. The design of tailor-made products and services has been adapted to customers, expectations and needs. Pay for your purchases in several instalments. The 4-star card is a revolving credit card that offers you the possibility, depending on the amount of your purchases and the brand, to pay in several instalments.

| Card Scheme |

| Carte 4Etoiles |

| cofidis3xcb |

| cofidis4xcb |

| facilypay-3x |

| fayilypay-3xsansfrais |

| facilypay-4x |

| facilypay-4xsansfrais |

Korea CC

KoreaCC is a payment method which enables Korean merchants (based in South Korea) to offer domestic customers (with Korean credit cards) a credit card payment method.

| Card Scheme |

| MasterCard |

| VISA |

| AMEX |

| JCB |

| KOOKMIN |

| KEB |

| BC |

| SHINHAN |

| SAMSUNG |

| HYUNDAI |

| LOTTE |

MasaPay

Shanghai MasaPay Information Technology Co., Ltd. is a third-party transnational e-payment service provider which was established in July 2012. Her headquarter is based in Lujiazui Financial Service District, Shanghai, China.

MasaPay offers an Online Payment Gateway, which supports credit card payment of Visa, MasterCard, JCB, AMEX, Discover, Diners etc. MasaPay makes it possible that the cross-border payments from outside China are acquired in China.

| Card Scheme |

| MasterCard |

| VISA |

| AMEX |

| Diners |

| Discover |

| JCB |

PagBrasil

Payments with the Brazilian credit cards Hipercard, Elo and Aura can be processed via the 1cs Online Payment System. The 1cs Online Payment Systemoffers extensive support for the control optimisation as well as foreign currency conversion.

More than 30% of online payments in Brazil are made using the Boleto Bancário cash-in solution. With a payment form customers can pay in cash in supermarkets, post office branches or at one of over 48,000 bank terminals.

PIX via PagBrasil is now also supported.

| Card Scheme |

| VISA |

| MasterCard |

| AMEX |

| Dines |

| Elo |

| Aura |

| Hipercard |

PayU India

With the integration of PayU biz India merchants open the door to a rapidly growing e-commerce market. Only 30% of online customers in India have access to internationally accepted payment methods. With the integration of PayU biz via the 1cs OPS merchants can offer 76 local payment methods to serve the majority of customers. This comprises of online transfers, credit and debit cards, eWallets and cash-in payments.

| Card Scheme |

| MasterCard |

| VISA |

| AMEX |

| Diners |

| RuPay |

PayU LatAm

Within the extremely heterogeneous e-commerce market of Latin America success depends on offering the requested payment methods. The integration of PayU gives the merchant access to 74 payment methods from Mexico to Argentina. Besides all major online transfers as well as credit and debit cards PayU also offers payments with modern e-wallets and popular cash-in-payments.

| Card Scheme |

| MasterCard |

| VISA |

| AMEX |

| Diners |

| Hipercard |

| Elo |

| NARANJA |

| SHOPPING |

| CABAL |

| ARGENDCARD |

| CENCOSUD |

2. Card processing – common form

2.1 Card processing – Credit Card Form

When requesting card payments via the 1cs Online Payment System hosted forms the complexity of 3-D Secure is completely removed from the merchant implementation.

From a merchant point of view the sequence itself does not differ between 3DS authenticated and non-authenticated payments though 3DS requires consideration of additional data elements in the request and response.

Notice about Cookie-/Session Handling: Please note that some browsers might block necessary cookies when returning to Your shop. Here you will find additional information and different solution approaches.

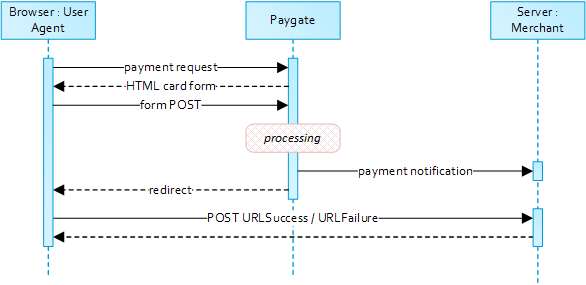

2.1.1 Simplified Sequence Diagram

When requesting card payments via the 1cs OPS hosted forms the complexity of 3-D Secure is completely removed from the merchant implementation.

From a merchant point of view the sequence itself does not differ between 3DS authenticated and non-authenticated payments though 3DS requires consideration of additional data elements in the request and response.

Notice about Cookie-/Session Handling: Please note that some browsers might block necessary cookies when returning to Your shop. Here you will find additional information and different solution approaches.

2.1.2 Payment Request

To retrieve a 1cs OPS card form please submit the following data elements via HTTP POST request method to https://www.computop-paygate.com/payssl.aspx.

Notice: For security reasons, the 1cs OPS rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

| Paramter | Format | CND | Bescheribung |

| MerchantID | ans..30 | M | MerchantID, assigned by the 1cs OPS. Additionally this parameter has to be passed in plain language too. |

| MsgVer | ans..5 | M | Message version. Valid values: Value: 2.0 Description: With 3-D Secure 2.x a lot of additional data were required (e.g. browser-information, billing/shipping-address, account-info, …) to improve authentication processing. To handle these information the JSON-objects have been put in place to handle such data. To indicate that these data are used the MsgVer has been implemented. |

| ReqID | ans..32 | O | To avoid double payments or actions (e.g. by ETM), enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction or action is submitted again with the same ReqID, the 1cs Online Payment System will not carry out the payment or new action, but will just return the status of the original transaction or action. Please note that the 1cs Online Payment System must have a finalized transaction status for the first initial action (authentication/authorisation). This does not apply to 3-D Secure authentications that are terminated by a timeout. The 3-D Secure Timeout status does not count as a completed status in which the ReqID functionality on the 1cs Online Payment System does not take effect. Submissions with identical ReqID for an open status will be processed regularly. Notice: Please note that a ReqID is only valid for 12 month, then it gets deleted at the 1cs Online Payment System. |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| RefNr | O | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional the 1cs Online Payment System settlement file (CTSF) we cannot add the additional payment data. Details on supported format can be found below in payment specific section. Only ASCII characters allowed, special characters (“Umlaute”, diacritics) are not allowed and must be replaced by their ASCII-representation (e.g. ü → ue, é → e, …). | |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HMAC Authentication (Request) HMAC Authentication (Notify) |

| Amount | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent). Please contact the Helpdesk, if you want to capture amounts <100 (smallest currency unit). |

| Currency | a3 | M | Currency, three digits DIN / ISO 4217, e.g. EUR, USD, GBP. Please find an overview here: Currency table |

| Capture | an..6 | OM | Determines the type and time of capture. AUTO: Capturing immediately after authorisation (default value). MANUAL: Capturing made by the merchant. Capture is normally initiated at time of delivery. <Number>: Delay in hours until the capture (whole number; 1 to 696). |

| PayTypes | ans..256 | O | With this parameter you can override the accepted schemes, i.e. you can decide within this parameter separated by pipe which of the available credit card schemes are displayed. The template must support this function like for example the “Cards_v1”. Example: PayTypes=VISA|MasterCard |

| BillingDescriptor | ans..22 | O | A descriptor to be printed on a card holder’s statement. Please also refer to the additional comments made elsewhere for more information about rules and regulations. |

| OrderDesc | ans..768 | O | Order description |

| AccVerify | a3 | O | Indicator to request an account verification (aka zero value authorization). If an account verification is requested the submitted amount will be optional and ignored for the actual payment transaction (e.g. authorization). Values accepted Yes |

| ThreeDSPolicy | JSON | O | Object specifying authentication policies and exemption handling strategies |

| PriorAuthenticationInfo | JSON | O | Prior Transaction Authentication Information contains optional information about a 3DS cardholder authentication that occurred prior to the current transaction |

| AccountInfo | JSON | O | The account information contains optional information about the customer account with the merchant |

| BillingToCustomer | JSON | C | The customer that is getting billed for the goods and / or services. Required for EMV 3DS unless market or regional mandate restricts sending this information. |

| ShipToCustomer | JSON | C | The customer that the goods and / or services are sent to. Required if different from billToCustomer. |

| BillingAddress | JSON | C | Billing address. Required for EMV 3DS (if available) unless market or regional mandate restricts sending this information. |

| ShippingAddress | JSON | C | Shipping address. If different from billingAddress, required for EMV 3DS (if available) unless market or regional mandate restricts sending this information. |

| CredentialOnFile | JSON | C | Object specifying type and series of transactions using payment account credentials (e.g. account number or payment token) that is stored by a merchant to process future purchases for a customer. Required if applicable. |

| MerchantRiskIndicator | JSON | O | The Merchant Risk Indicator contains optional information about the specific purchase by the customer. If no shippingAddress is present it is strongly recommended to populate the shippingAddressIndicator property with an appropriate value such as shipToBillingAddress, digitalGoods or noShipment. |

| SubMerchantPF | JSON | O | Object specifying SubMerchant (Payment Facilitator) details. Only supported by SafeCharge |

| URLSuccess | ans..256 | M | Complete URL which calls up the 1cs Online Payment System if payment has been successful. The URL may be called up only via port 443. This URL may not contain parameters: In order to exchange values between the 1cs Online Payment System and shop, please use the parameter UserData. Common notes: We recommend to use parameter “response=encrypt” to get an encrypted response by the 1cs Online Payment System However, fraudster may just copy the encrypted DATA-element which are sent to URLFailure and send the DATA to URLSuccess. Therefore ensure to check the “code”-value which indicates success/failure of the action. Only a result of “code=00000000” should be considered successful. |

| URLFailure | ans..256 | M | Complete URL which calls up the 1cs OPS if payment has been unsuccessful. The URL may be called up only via port 443. This URL may not contain parameters: In order to exchange values between the 1cs OPS and shop, please use the parameter UserData. Common notes: We recommend to use parameter “response=encrypt” to get an encrypted response by the 1cs Online Payment System However, fraudster may just copy the encrypted DATA-element which are sent to URLFailure and send the DATA to URLSuccess/URLNotify. Therefore ensure to check the “code”-value which indicates success/failure of the action. Only a result of “code=00000000” should be considered successful. |

| URLBack | ans..256 | O | Complete URL which the 1cs Online Payment System calls in case that Cancel is clicked by the customer. The parameter “URLBack” can be sent either as plain parameter (unencrypted) (compatibility mode) or be part of encrypted payment request parameters (preferred mode) In order to exchange values between the 1cs Online Payment System and shop you may use something like this: URLBack=https://your.shop.com/back.php?param1%3Dvalue1%26param2%3Dvalue3%26status%3Dcancelled When user cancels payment this URL is called exactly like this and you may use URL Decode to extract parameter and values. |

| Response | a7 | O | Status response sent by the 1cs OPS to URLSuccess and URLFailure, should be encrypted. For this purpose, transmit Response=encrypt parameter. |

| URLNotify | ans..256 | M | Complete URL which the 1cs Online Payment System calls up in order to notify the shop about the payment result. The URL may be called up only via port 443. It may not contain parameters: Use the UserData parameter instead. Common notes: We recommend to use parameter “response=encrypt” to get an encrypted response by the 1cs Online Payment System However, fraudster may just copy the encrypted DATA-element which are sent to URLFailure and send the DATA to URLSuccess/URLNotify. Therefore ensure to check the “code”-value which indicates success/failure of the action. Only a result of “code=00000000” should be considered successful. |

| UserData | ans..1024 | O | If specified at request, the 1cs OPS forwards the parameter with the payment result to the shop. |

| Custom | ans..1024 | O | “Custom”-parameter is added to the request data before encryption and is part of encrypted “Data” in the 1cs OPS request. By this they are protected against manipulation by a consumer. The Custom-value is added to the1cs Online Payment System response in plain text and the “|” is replaced by a “&”. By this you can put a single value into Custom-parameter and get multiple key-value-pairs back in response for your own purpose. |

| Plain | ans..50 | O | A single value to be set by the merchant to return some information unencrypted in response/notify, e.g. the MID. “Plain”-parameter is part of encrypted “Data” in 1cs Online Payment System and therefore protected against manipulation. |

| ExpirationTime | ans..19 | O | Timestamp for the end time of the transaction processing, specified in UTC. Format: YYYY-MM-ddTHH:mm:ss |

The 1cs Online Payment System will return an HTML document in the response body representing the requested card form. The form may be included in the merchant checkout page or used as a standalone page to redirect the card holder to.

Card holder authentication and payment authorization will take place once the the cardholder entered all required card details and submitted the form data to the 1cs Online Payment System.

Note: In case you are using your own templates (Corporate Payment Page), please make sure you include Cardholder name on your custom template. Cardholder name is mapped to Paygate API parameter “CreditCardHolder”. Cardholder name field must not contain any special characters and must have minimal length of 2 characters and maximum length of 45 characters.

When the payment is completed the 1cs Online Payment Systeme will send a notification to the merchant server (i.e. URLNotify) and redirect the browser to the URLSuccess respectively to the URLFailure.

The blowfish encrypted data elements as listed in the following table are transferred via HTTP POST request method to the URLNotify and URLSuccess/URLFailure.

Notice: Please note that the call of URLSuccess or URLFailure takes place with a GET in case of fallback to 3-D Secure 1.0. Therefore your systems should be able to receive parameters both via GET and via POST.

The credit card form can be highly customized by using your own template.

Details are available here: Corporate PayPage and templates

2.1.3 HTTP POST to URLSuccess / URLFailure / URLNotify

The following table gives the result parameters which the 1cs Online Payment System transmits to URLSuccess or URLFailure and URLNotify. If you have specified the Response=encrypt parameter, the following parameters are sent Blowfish encrypted to your system:

- be prepared to receive additional parameters at any time and do not check the order of parameters

- the parameters (e.g. MerchantId, RefNr) should not be checked case-sentive

| Parameter | Format | CND | Beschreibung | |

| MID | ans..30 | M | MerchantID, assigned by the 1cs Online Payment System | |

| MsgVer | ans..5 | M | Valid Values: Wert: 2.0 Description: With 3-D Secure 2.x a lot of additional data were required (e.g. browser-information, billing/shipping-address, account-info, …) to improve authentication processing. To handle these information the JSON-objects have been put in place to handle such data. To indicate that these data are used the MsgVer has been implemented. | |

| PayID | an32 | M | ID assigned by the 1cs Online Payment System for the payment, e.g. for referencing in batch files as well as for capture or credit request. | |

| XID | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by the 1cs Online Payment System | |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment | |

| SchemaReferenceID | ans..64 | C | Card scheme specific transaction ID required for subsequent credential-on-file payments, delayed authorizations and resubmissions. Mandatory: CredentialOnFile – initial false – unscheduled MIT / recurring schemeReferenceID is returned for 3DS2-payments. In case of fallback to 3DS1 you will also need to check for TransactionId. The schemeReferenceID is a unique identifier generated by the card brands and as a rule the 1cs Online Payment System merchants can continue to use the SchemeReferenceIDs for subscription plans that were created while using another PSP environment / Paygate MerchantID / Acquirer ContractID / Acquirer. | |

| RefNR | O | Reference number taken from request | ||

| Status | a..20 | M | Status of the transaction. Values accepted: Authorized OK (Sale) FAILED In case of Authentication-only the Status will be either OK or FAILED. | |

| Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! | |

| Code | n8 | M | Error code according to Paygate Response Codes (A4 Error codes) | |

| Card | JSON | M | Card data | |

| IpInfo | JSON | O | Object containing IP informationen | |

| ThreeDsData | JSON | M | Authentisierung data | |

| ResultResponse | JSON | C | In case the authentication process included a cardholder challenge additional information about the challenge result will be provided. | |

| ExternalPaymentData | JSON | O | Optional additional data from acquirer/issuer/3rd party for authorization. | |

| TimeStamp | Date/Time | O | Timestamp of this action if activated by Helpdesk, e.g. 30.05.2023 08:47:57 or 30.05.2023 10:03:01.633 | |

| CardHolder | ans..50 | O | Card holder name if activated by Helpdesk, e.g. John Doe | |

| bin | n..6 | O | BIN of credit card if activated by Helpdesk, e.g. 40001 | |

| maskedpan | an..19 | O | Masked number of credit card if activated by Helpdesk, e.g. 400001XXXXXX8323 | |

| cardinfo | JSON | O | JSON containing data of credit card type and issuer if activated by Helpdesk, e.g. {“BIN”:”400001″,”Brand”:”VISA”,”Product”:””,”Source”:”CREDIT”,”Type”:””,”Country”:{“A3″:”USA”,”N3″:”840″},”Issuer”:””} | |

| CCBrand | an..20 | O | Brand / card scheme of credit card, e.g. VISA | |

| PCNr | n16 | O | Pseudo Card Number: Random number generated by the 1cs OPS which represents a genuine credit card number. The pseudo card number (PCN) starts with 0 and the last 3 digits correspond to those of the real card number. The PCN can be used like a genuine card number for authorisation, capture and credits. PCNr is a response value from the 1cs OPS and is sent as CCNr in Request or part of card-JSON | |

| CCExpiry | n6 | OC | Optional in combination with PCNr: Expiry date of the credit card in the format YYYYMM (202207). | |

| Plain | ans..50 | O | Single value to be set by the merchant to return some information unencrypted in response/notify, e.g. the MID. “Plain”-parameter is part of encrypted “Data” in the 1cs OPS and therefore protected against manipulation. | |

| Custom | ans..1024 | O | “Custom”-parameter is added to the request data before encryption and is part of encrypted “Data” in the 1cs Online Payment System request. By this they are protected against manipulation by a consumer. The Custom-value is added to the 1cs OPS response in plain text and the “|” is replaced by a “&”. By this you can put a single value into Custom-parameter and get multiple key-value-pairs back in response for your own purpose. | |

| UserData | ans..1024 | O | If specified at request, 1cs Online Payment System forwards the parameter with the payment result to the shop. | |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HMAC-Authentisierung (Request) HMAC-Authentisierung (Notify) |

2.1.4 Credit card payments with separate authorisation

For credit card payments the ORDER can be separated from the subsequent authorisation and the following steps. Therefore initially the SSL credit card payment is initiated via the 1cs OPS form or via Server-to-Server-connection like in the chapters above with an additional parameter. Later it is authorised using the interface authorize.aspx via server-to-server connection. For initialising visit the following URL:

https://www.computop-paygate.com/payssl.aspx

For Server-to-Server-connection it is the following URL:

https://www.computop-paygate.com/direct.aspx

The following table describes the encrypted payment request parameters:

| Key | Format | CND | Description |

| TxType | ans..20 | M | Submit “Order” to initialize a payment which later will be authorised via interface authorize.aspx. Please note that in combination with the used 3-D Secure method a separate setting is necessary. Please contact directly 1cs Helpdesk. |

In order to authorise a previously with TxType=Order initiated SSL credit card payment, please visit the following URL:

https://www.computop-paygate.com/authorize.aspx

Notice: Please note, that for an initial order KPN/CVC/CVV-check is not possible. For the subsequent reservation request this ID also cannot be passed on.

Notice: For security reasons, the 1cs OPS rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

| Key | Format | CND | Description |

| MerchantID | ans..30 | M | MerchantID, assigned by the 1cs Online Payment System. Additionally this parameter has to be passed in plain language too. |

| PayID | an32 | M | ID assigned by the 1cs Online Payment System for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| Amount | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent). Please contact the Helpdesk, if you want to capture amounts <100 (smallest currency unit). |

| Currency | a3 | M | Currency, three digits DIN / ISO 4217, e.g. EUR, USD, GBP. Please find an overview here: Currency table |

| OrderDesc | ans..768 | O | Description of purchased goods, unit prices etc. |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HMAC Authentication (Request) HMAC Authentication (Notify) |

| Capture | an..6 | M | Determines the type and time of capture. AUTO: Capturing immediately after authorisation (default value). MANUAL: Capturing made by the merchant. Capture is normally initiated at time of delivery. <Number>: Delay in hours until the capture (whole number; 1 to 696). |

The following table describes the result parameters with which the 1cs online payment system responds to your system

Notice: be prepared to receive additional parameters at any time and do not check the order of parameters

Notice: the parameters (e.g. MerchantId, RefNr) should not be checked case-sentive

| Key | Format | CND | Description |

| MID | ans..30 | M | MerchantID, assigned by the 1cs Online Payment System |

| PayID | an32 | M | ID assigned by the 1cs Online Payment System for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| XID | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by the 1cs Online Payment System |

| Code | n8 | M | Error code according to Paygate Response Codes (A4 Error codes) |

| Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| Status | a..50 | M | AUTHORIZED or FAILED |

| RefNr | O | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional the 1cs Online Payment System settlement file (CTSF) we cannot add the additional payment data. Details on supported format can be found below in payment specific section. Only ASCII characters allowed, special characters (“Umlaute”, diacritics) are not allowed and must be replaced by their ASCII-representation (e.g. ü → ue, é → e, …). |

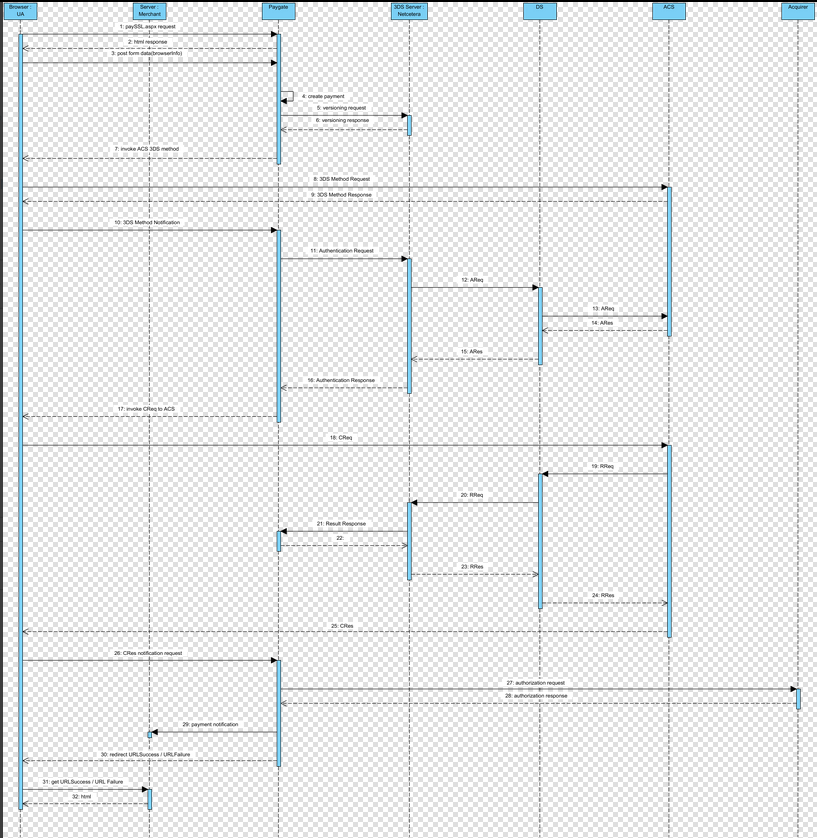

2.1.5 Extended sequence diagram

2.2 Corporate PayPage

The 1cs Online Payment System forms are framed as standard in white and grey. Merchants can customise the layout of the forms with the help of layout parameters. The simplest way to change the layout is to set the parameters for the background colour (BGColor), background image (BGImage) and the font (FFace). You can use XSL-templates to change the layout further:

In the case of credit card payments you can change the parameter Template to create an individual layout for your PaySSL form which exactly matches the shop layout. To this end your graphic designer can design an HTML-template in the shop-design based on XSLT (Extensible Stylesheet Language Transformation). First Cash Solution Support copies this XSLT-template to our the 1cs Online Payment System Server. If you enter the name of your XSLT-file in the Template parameter, the 1cs Online Payment System form will appear in your layout.

For general information about XSLT see www.w3.org.

Please note, that the 1cs OPS is a fee-based additional service. Please ask 1cs OPS Sales thereun.

1cs OPS provides a programming example for creating a responsive credit card form online at https://www.computop.com/de/xslt. The template files to be created – XSL and XML – afterwards are transformed automatically for the various browsers. Please ensure before sending to the 1cs Online Payment System that both files can be loaded into the browser correctly. The complete code must be able to be displayed and no error message are allowed. If an error message occurs the code and used tags have to be revised. Please note that new versions must be available not later then 3:30 pm in order to to be processed on the same day.

The subsequent conventions apply for the use of the Corporate Paypage with XSLT:

2.2.1 File names

A XSL file designed by you defines your individual layout. The associated XML file contains the texts that are to be displayed on the form. Hence, multilingualism is easy. Always use your MerchantID in the names of the files.

XSL template: MerchantID_PaySSL.xsl

XML text file: MerchantID_PaySSL.xml

Sub-folder for images: Templates/imagesMerchantID

In order not to receive safety notices, please ensure that external image sources are retrieved via SSL.

In order to call the individual layout, use the ‘template’ parameter with your MerchantID and attach it unencrypted to the call of the First Cash Solution payment page, for example: https://www.computop-paygate.com/payssl.aspx?MerchantID=IhreMID&Len=123&Data=AGSDJ…ASDF&template=IhreMerchantID

2.2.2 Field names of the form

When implementing the text field for the credit card number, use the following values for the parameters ‘name’ and ‘id’:

Year of expiry: „cardExpirationYear“

Expiry date month: „cardExpirationMonth“

Credit card number: „cardNumber“

Card verification number: „cccvc“

Card brand: „ccBrand“

A text field for the input of the credit card number is then implemented as follows:

<input type=”text” name=”KKNr” id= “KKNr” value=””></input>

2.2.3 Hidden Fields

The following hidden fields must be implemented so that the values can be passed on when sending the form:

| ID | Value | Notes |

| MerchantID | MerchantID | MerchantId assigned by the 1cs Online Payment System |

| Len | Request length | Length of unencrypted (!) data before encryption |

| Data | Request Data | Encrypted data |

| Template | Template | Template name |

| Counter | Repeat attempts | |

| Language | Language | |

| Notify | Notify | optional in the case of repeat attempts |

| AddrChoice | Address choice | Only with American Express Adress Verification Service |

2.2.4 Language selection

The language selection in form PaySSL.aspx is automatically based on the parameter Language. Other language areas are filtered out. If you wish to access the field of another language area e.g. with JavaScript, you can do so via the following path: paygate/language/@name.

2.2.5 XML structure

The ‘language’ parameter controls which section of the XML text file is read out. German ‘de’ is always used as standard.

The XML file should have the following basic structure:

<?xml version="1.0" encoding="windows-1252"?>

</languages> <language name="de"> </language> <language name="en"> </language> </languages>

‘UTF-8’ is also possible for the encoding.

With <xsl:variablename=““ select=“paygate/language/@name”/> you can directly address an XML language section from the XSL file.

For an overview of which parameters are additionally rendered by the PaySSL, please examine the following structure (XSL file is rendered against the following XML string):

strXML = “<?xml version=’1.0′ encoding=’windows-1252′?>” & _

“<paygate pay=’ssl’>” & _

“<merchantID>”…”</merchantID>” & _

“<len>”…”</len>” & _

“<data>”…”</data>” & _

“<Background>”…”</Background>” & _

“<BGImage>”…”</BGImage>” & _

“<BGColor>”…”</BGColor>” & _

“<FFace>”…”</FFace>” & _

“<FSize>”…”</FSize>” & _

“<FColor>”…”</FColor>” & _

“<center>”…”</center>” & _

“<CCard>”…”</CCard>” & _

“<Year>”…”</Year>” & _

“<URLBack>”…”</URLBack>” & _

“<twidth>”…”</twidth>” & _

“<theight>”…”</theight>” & _

“<brands><brand>”…”</brand></brands>” &_

“<cvc>”…”</cvc>” &_

“<ccexpiryyear>” … “</ccexpiryyear>” & _

“<ccbrand>” … “</ccbrand>” & _

“<template>”…”</template>” & _

“<counter>”… “</counter>” & _

“<notify>”… “</notify>” & _

“<errorcode>”…”</errorcode>” & _

“<PCNr>”…”</PCNr>” & _

“<PCNrBrand>”… “</PCNrBrand>” & _

“<PCNrMonth>”… “</PCNrMonth>” & _

“<PCNrYear>”… “</PCNrYear>” & _

“<creditcardholder>” … “</creditcardholder>” & _

“<Autostart>”…”</Autostart>” & _

<language/@name … (Area for selected language-Node)

(content of MerchantId_PaySSL.xml in the respective language)>

“</paygate>”

Since merchants use its own layout for the form, you do not require the layout parameter. However, it is possible after prior consultation with First Cash Solution to use the parameters for the transfer, e.g. the SessionID.

2.2.6 Error mapping

In the case of the error codes listed below First Cash Solution returns the form in order to enable the credit card data to be entered again. You only have to evaluate the ‘error code’ parameter and display the desired text from your XML file.

At this point the ‘error code’ template is called:

<xsl:apply-templates select=“/paygate/errorcode” />

The called-up ‘error code’ template may look like this. It can alternatively be implemented with ‘if’.

<xsl:template match="errorcode">

<tr> <td> <xsl:choose> <xsl:when test=".='0015'"> <xsl:value-of select="/paygate/language/ErrorCodeDescription/Description1"/> <!--The input of the credit card number was not correct--> </xsl:when> ... </xsl:choose> </td> </tr> </xsl:template>

It is also possible to integrate the error messages directly into the (main) template:

<xsl:if test="paygate/errorcode != ''">

<xsl:choose> <xsl:when test="paygate/errorcode='0015'"> <xsl:value-of select="/paygate/language/ErrorCodeDescription/Description1"/> <!--The input of the credit card number was not correct--> </xsl:when> </xsl:choose> </xsl:if>

2.2.7 JavaScript

If JavaScript functions are desired, you must implement them in your template.

<script id=“clientEventHandlersJS“ language=“JavaScript“>

if (document.SSLForm.cardNumber.value.length> 19)

{

alert(„<xsl:value-of select=“/paygate/language/strJavaScript1“/>“);

document.SSLForm.cardNumber.focus();

}

...

</script>

Please do not use any external link to your JavaScript.

2.2.8 Link to Visa Secure and MasterCard Secure Code

Visa and MasterCard regulations require that your pay page displays the Visa Secure and SecureCode logo. Please link the Verified logo to https://www.computop-paygate.com/vbv.aspx and the SecureCode logo to https://brand.mastercard.com/brandcenter/mastercard-brand-mark/downloads.html.

2.2.9 Programming and testing the form

First design a HTML page with the layout for your payment page and initially save it for testing with the file extension .htm or .html. Open this file in the browser. Next, save this as an xsl file.

<?xml version="1.0" encoding="windows-1252"?>

<xsl:stylesheet version="1.0" xmlns:xsl="http://www.w3.org/1999/XSL/Transform">

<xsl:output method="html" encoding="UTF-8"/>

<xsl:template match="/">

<html>

<head>

<title>PaySSL Template</title>

<script>Your JavaScript</script>

</head>

<body>

<form action="https://www.computop-paygate.com/payinterim.aspx" method="POST">

Your form with hidden fields and xsl-tags

</form>

</body>

</html>

</xsl:template>

In order to read the texts from the XML file, first of all create your tags in the desired language sections with the texts:

<language name="de">

<strCCNumber>credit card number</strCCNumber>

</language>

Subsequently, replace the text in the HTML by a reference to the respective section in the XML file:

<xsl:value-of select="/paygate/language/strCCNumber"/>

In order to test your template, we request that you integrate the following lines in your XML file only for the test (before sending it to First Cash Solution) and afterwards to call up the XML file in a browser. If no error is displayed you can send your template and the image folder in a Zip file to First Cash Solution’s Support with a request to check and install it.

<?xml version="1.0" encoding="windows-1252"?>

<?xml-stylesheet type="text/xsl" href="templatename.xsl"?>

<paygate>

<languages>please omit for your layout tests

<language name="de">

</language>

<language name="en">

</language>

<languages>please omit for your layout tests

</paygate>

In order to get an overview of the versions, please include the date and version number in the name of your Zip file.

As with the credit card form, it is now also possible to design your own XSLT templates for the SEPA direct debit form. In exactly the same way as with the credit card form, this is controlled via the ‘Template’ parameter. This can be called via the following URL:

The files must use the following naming convention:

XSL template: MerchantID_PaySDD.xsl

XML text file: MerchantID_PaySDD.xml

Sub-folder for images: Templates/imagesMerchantID

Notice: A Corporate Paypage offers you much more extended functions like for example a preconfiguration of card data which are not explained in detail here. For questions about extended functions please consult the 1cs Online Payment System Support.

3. Server-2-Server Sequence Diagram

3.1 Card processing – Server-2-Server integration

A 3-D Secure 2.0 payment sequence may comprise the following distinct activities:

- Versioning: Request ACS and DS Protocol Version(s) that correspond to card account range as well as an optional 3-D Secure Method URL

- 3-D Secure Method:Connect the cardholder browser to the issuer ACS to obtain additional browser data

- Authentication: Submit authentication request to the issuer ACS

- Challenge: Challenge the card holder if mandated

- Authorization:Authorize the authenticated transaction with the acquirer

3.2 Server-2-Server Sequence Diagram

Please note that the the communication between client and Access Control Server (ACS) is implemented through iframes. Thus, responses arrive in an HTML subdocument and you may establish correspondent event listeners in your root document.

Alternatively you could solely rely on asynchronous notifications delivered to your backend. In those cases you may have to consider methods such as long polling, SSE or websockets to update the client.

3.3 Payment Initiation

The initial request to the 1cs Online Payment System will be the same regardless of the underlying 3-D Secure Protocol.

In order to start a server-to-server 3-D Secure card payment sequence please post the following key-value-pairs to https://www.computop-paygate.com/ direct.aspx.

3.4 Call of interface: general parameters

Notice: For credit card payments with 3D Secure, please note the different cases as explained separately in the chapter at the start of the handbook. If the credit card is registered for Verified or SecureCode or SafeKey, the next phase is divided into two steps of authentication and payment. However it always begins in the same way via the direct.aspx interface. The first response however is the receipt of Javascript code or other parameters in order to carry out a second call up of the direct3d.aspx interface. Only after that, do you receive the listed parameter as a response.

To carry out a TLS credit card payment via a Server-to-Server connection, call the following URL:

https://www.computop-paygate.com/direct.aspx

3.4.1 Request Elements

Notice: For security reasons, the 1cs Online Payment System rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

Notice: In case of a merchant initiated recurring transaction the JSON objects (besides credentialOnFile and card), the URLNotify and TermURL are not mandatory parameters, because no 3-D Secure and no risk evaluation is done by the card issuing bank and the payment result is directly returned within the response.

| Parameter | Format | CND | Beschreibung |

| MerchantID | ans..30 | M | MerchantID, assigned by 1cs Online Payment System. Additionally this parameter has to be passed in plain language too. |

| MsgVer | ans..5 | M | Message version. Valid values: Value: 2.0 Description: With 3-D Secure 2.x a lot of additional data were required (e.g. browser-information, billing/shipping-address, account-info, …) to improve authentication processing. To handle these information the JSON-objects have been put in place to handle such data. To indicate that these data are used the MsgVer has been implemented. |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| ReqID | ans..32 | O | To avoid double payments or actions (e.g. by ETM), enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction or action is submitted again with the same ReqID, 1cs OPS will not carry out the payment or new action, but will just return the status of the original transaction or action. Please note that the 1cs Online Payment System must have a finalized transaction status for the first initial action (authentication/authorisation). This does not apply to 3-D Secure authentications that are terminated by a timeout. The 3-D Secure Timeout status does not count as a completed status in which the ReqID functionality on the 1cs Online Payment System does not take effect. Submissions with identical ReqID for an open status will be processed regularly. Notice: Please note that a ReqID is only valid for 12 month, then it gets deleted at the 1cs Online Payment System . |

| RefNr | O | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional 1cs OPS settlement file (CTSF) we cannot add the additional payment data. Details on supported format can be found below in payment specific section. Only ASCII characters allowed, special characters (“Umlaute”, diacritics) are not allowed and must be replaced by their ASCII-representation (e.g. ü → ue, é → e, …). | |

| SchemaReferenceID | ans..64 | C | Card scheme specific transaction ID required for subsequent credential-on-file payments, delayed authorizations and resubmissions. Mandatory: CredentialOnFile – initial false – unscheduled MIT / recurring schemeReferenceID is returned for 3DS2-payments. In case of fallback to 3DS1 you will also need to check for TransactionId. The schemeReferenceID is a unique identifier generated by the card brands and as a rule the 1cs Online Payment System merchants can continue to use the SchemeReferenceIDs for subscription plans that were created while using another PSP environment / 1cs OPS MerchantID / Acquirer ContractID / Acquirer. |

| IndustrySpecificTxType | ans..10 | C | This parameter is required whenever an industry specific transaction is processed according to the card brands MIT (Merchant Initiated Transactions) Framework, i.e.: specific use cases like described below. Only supported with Omnipay and GICC. Supported with CB2A for Reauthorization, only. Values: Resubmission: A merchant performs a re-submission in cases where it requested an authorization, but received a decline due to insufficient funds; however, the goods or services were already delivered to the cardholder. Merchants in such scenarios can resubmit the request to recover outstanding debt from cardholders. Reauthorization: A merchant initiates a re-authorization when the completion or fulfillment of the original order or service extends beyond the authorization validity limit set by Visa. There are two common re-authorization scenarios: • Split or delayed shipments at eCommerce retailers. A split shipment occurs when not all the goods ordered are available for shipment at the time of purchase. If the fulfillment of the goods takes place after the authorization validity limit set by Visa, eCommerce merchants perform a separate authorization to ensure that consumer funds are available. • Extended stay hotels, car rentals, and cruise lines. A re-authorization is used for stays, voyages, and/or rentals that extend beyond the authorization validity period set by Visa. DelayedCharges: Delayed charges are performed to process a supplemental account charge after original services have been rendered and respective payment has been processed. NoShow: Cardholders can use their Visa cards to make a guaranteed reservation with certain merchant segments. A guaranteed reservation ensures that the reservation will be honored and allows a merchant to perform a No Show transaction to charge the cardholder a penalty according to the merchant’s cancellation policy. Note: For merchants that accept token-based payment credentials to guarantee a reservation, it is necessary to perform a CIT (Account Verification Service) at the time of reservation to be able perform a No Show transaction later. Hinweis: Für Händler, die tokenbasierte Zahlungsinformationen akzeptieren, um eine Reservierung zu garantieren, ist es zum Zeitpunkt der Reservierung erforderlich, einen CIT (Kontoverifizierungsservice) durchzuführen, um später eine No-Show-Transaktion durchführen zu können. Note: It is always submitted in conjunction with the “schemeReferenceID” parameter. Please contact 1cs Helpdesk for the supported Acquirer and card brands. |

| Amount | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent). Please contact the 1cs Helpdesk, if you want to capture amounts <100 (smallest currency unit). |

| Currency | a3 | M | Currency, three digits DIN / ISO 4217, e.g. EUR, USD, GBP. Please find an overview here: Currency table |

| Card | JSON | M | Card data |

| Capture | ans..6 | O | Determines the type and time of capture. AUTO: Capturing immediately after authorisation (default value). MANUAL: Capturing made by the merchant. Capture is normally initiated at time of delivery. <Number>: Delay in hours until the capture (whole number; 1 to 696). |

| BillingDescriptor | ans..22 | O | A descriptor to be printed on a card holder’s statement. Please also refer to the additional comments made elsewhere for more information about rules and regulations. |

| OrderDesc | ans..768 | M | Order description |

| AccVerify | JSON | O | Indicator to request an account verification (aka zero value authorization). If an account verification is requested the submitted amount will be optional and ignored for the actual payment transaction (e.g. authorization). Values accepted: Yes |

| ThreeDSPolicy | JSON | O | Object specifying authentication policies and exemption handling strategies |

| ThreeDSData | JSON | C | Object detailing authentication data in case authentication was performed through a third party or by the merchant |

| PriorAuthenticationInfo | JSON | O | Prior Transaction Authentication Information contains optional information about a 3-D Secure cardholder authentication that occurred prior to the current transaction |

| BrowserInfo | JSON | C | Accurate browser information are needed to deliver an optimized user experience. Required for 3-D Secure 2.0 transactions. |

| AccountInfo | JSON | O | The account information contains optional information about the customer account with the merchant. Optional for 3-D Secure 2.0 transactions. |

| BillToCustomer | JSON | C | The customer that is getting billed for the goods and / or services. Required unless market or regional mandate restricts sending this information. |

| ShipToCustomer | JSON | C | The customer that the goods and / or services are sent to. Required (if available and different from billToCustomer) unless market or regional mandate restricts sending this information. |

| BillingAddress | JSON | C | Billing address. Required for 3-D Secure 2.0 (if available) unless market or regional mandate restricts sending this information. |

| ShippingAddress | JSON | C | Shipping address. If different from billingAddress, required for 3-D Secure 2.0 (if available) unless market or regional mandate restricts sending this information. |

| CredentialOnFile | JSON | C | Object specifying type and series of transactions using payment account credentials (e.g. account number or payment token) that is stored by a merchant to process future purchases for a customer. Required if applicable. |

| MerchantRiskIndicator | JSON | O | The Merchant Risk Indicator contains optional information about the specific purchase by the customer |

| SubMerchantPF | JSON | O | Object specifying SubMerchant (Payment Facilitator) details Only supported by SafeCharge |

| TermURL | ans..256 | M | Only for 3-D Secure: URL of the shop which has been selected by the Access Control Server (ACS) of the bank to transmit the result of the authentication. The bank transmits the parameters PayID, TransID and MerchantID via GET and the PAResponse parameter via POST to the TermURL. In case of a merchant initiated recurring transaction the JSON objects (besides credentialOnFile and card), the URLNotify and TermURL are not mandatory parameters, because no 3-D Secure and no risk evaluation is done by the card issuing bank and the payment result is directly returned within the response. |

| URLNotify | ans..256 | M | Complete URL which the 1cs Online Payment System calls up in order to notify the shop about the payment result. The URL may be called up only via port 443. It may not contain parameters: Use the UserData parameter instead. In case of a merchant initiated recurring transaction the JSON objects (besides credentialOnFile and card), the URLNotify and TermURL are not mandatory parameters, because no 3-D Secure and no risk evaluation is done by the card issuing bank and the payment result is directly returned within the response. Common notes: We recommend to use parameter “response=encrypt” to get an encrypted response by the 1cs Online Payment System However, fraudster may just copy the encrypted DATA-element which are sent to URLFailure and send the DATA to URLSuccess/URLNotify. Therefore ensure to check the “code”-value which indicates success/failure of the action. Only a result of “code=00000000” should be considered successful. |

| UserData | ans..1024 | O | If specified at request, Paygate forwards the parameter with the payment result to the shop. |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HMAC Authentication (Request) HMAC Authentication (Notify) |

Notice: Please note the additional parameter for a specific credit card integration in the section “Specific parameters”

3.4.2 Response Elements (authentication)

The following table describes the result parameters with which the 1cs online payment system responds to your system

Notice: be prepared to receive additional parameters at any time and do not check the order of parameters

Notice: the parameters (e.g. MerchantId, RefNr) should not be checked case-sensitive

| Parameter | Format | CND | Beschreibung |

| MID | ans..30 | M | MerchantID, assigned by the 1cs OPS |

| PayID | an32 | M | ID assigned by the 1cs OPS for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| XID | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by the 1cs Online Payment System |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| RefNr | O | Reference number as given in request | |

| Status | a..20 | M | Status of the transaction. Values accepted: AUTHENTICATION_REQUEST PENDING FAILED |

| Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

| Code | n8 | M | Error code according to Paygate Response Codes (A4 Error codes) |

| UserData | ans..1024 | O | If specified at request, the 1cs OPS forwards the parameter with the payment result to the shop. |

| Card | JSON | M | Card data |

| VisioningData | JSON | M | The Card Range Data data element contains information that indicates the most recent EMV 3-D Secure version supported by the ACS that hosts that card range. It also may optionally contain the ACS URL for the 3-D Secure Method if supported by the ACS and the DS Start and End Protocol Versions which support the card range. |

| ThreeDSLegacy | JSON | C | Object containing the data elements required to construct the Payer Authentication request in case of a fallback to 3-D Secure 1.0. |

3.4.3 versioningData

The versioningData object will indicate the EMV 3-D Secure protocol versions (i.e. 2.1.0 or higher) that are supported by Access Control Server of the issuer.

If the corresponding protocol version fields are NULL it means that the BIN range of card issuer is not registered for 3-D Secure 2.0 and a fallback to 3-D Secure 1.0 is required for transactions that are within the scope of PSD2 SCA.

When parsing versioningData please also refer to the subelement errorDetails which will specify the reason if some fields are not pupoluated (e.g. Invalid cardholder account number passed, not available card range data, failure in encoding/serialization of the 3-D Secure Method data etc).

BASEURL= https://www.computop-paygate.com/

{

“threeDSServerTransID”: “14dd844c-b0fc-4dfe-8635-366fbf43468c”,

“acsStartProtocolVersion”: “2.1.0”,

“acsEndProtocolVersion”: “2.1.0”,

“dsStartProtocolVersion”: “2.1.0”,

“dsEndProtocolVersion”: “2.1.0”,

“threeDSMethodURL”: “http://www.acs.com/script“,

“threeDSMethodDataForm”: “eyJ0aHJlZURTTWV0aG9kTm90aWZpY2F0aW9uVVJMIjoiaHR0cHM6Ly93d3cuY29tcHV0b3AtcGF5Z2F0ZS5jb20vY2JUaHJlZURTLmFzcHg_YWN0aW9uPW10aGROdGZuIiwidGhyZWVEU1NlcnZlclRyYW5zSUQiOiIxNGRkODQ0Yy1iMGZjLTRkZmUtODYzNS0zNjZmYmY0MzQ2OGMifQ==”,

“threeDSMethodData”: {

“threeDSMethodNotificationURL”: “BASEURL/cbThreeDS.aspx?action=mthdNtfn”,

“threeDSServerTransID”: “14dd844c-b0fc-4dfe-8635-366fbf43468c”

}

}

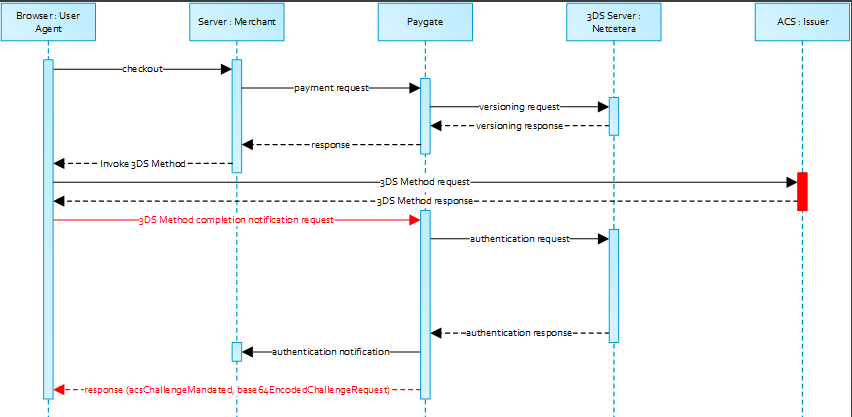

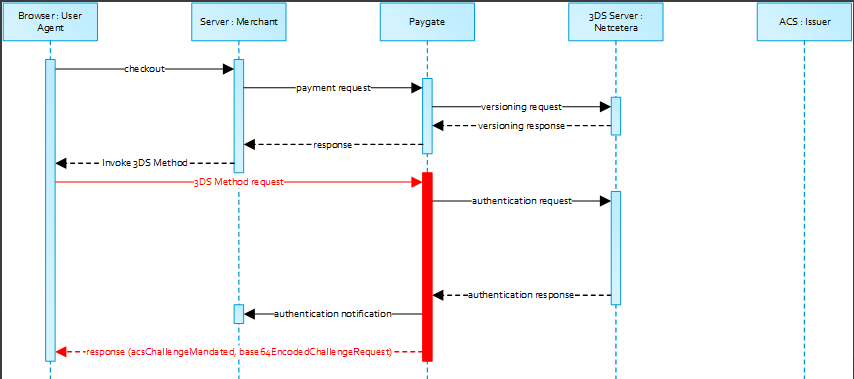

3.5 3-D Secure Method

The 3-D Secure Method allows for additional browser information to be gathered by an ACS prior to receipt of the authentication request message (AReq) to help facilitate the transaction risk assessment. Support of 3-D Secure Method is optional and at the discretion of the issuer.

The versioningData object contains a value for threeDSMethodURL . The merchant is supposed to invoke the 3-D Secure Method via a hidden HTML iframe in the cardholder browser and send a form with a field named threeDSMethodData via HTTP POST to the ACS 3-D Secure Method URL.

3.5.1 3-D Secure Method: threeDSMethodURL

Please note that the threeDSMethodURL will be populated by the 1cs Online Payment System if the issuer does not support the 3-D Secure Method. The 3-D Secure Method Form Post as outlined below must be performed independently from whether it is supported by the issuer. This is necessary to facilitate direct communication between the browser and the 1cs Online Payment System in case of a mandated challenge or a frictionless flow.

3.5.2 3-D Secure Method: No issuer threeDSMethodURL

3.5.3 3-D Secure Method Form Post

<form name=”frm” method=”POST” action=”Rendering URL”>

<input type=”hidden” name=”threeDSMethodData” value=”eyJ0aHJlZURTU2VydmVyVHJhbnNJRCI6IjNhYzdjYWE3LWFhNDItMjY2My03OTFiLTJhYzA1YTU0MmM0YSIsInRocmVlRFNNZXRob2ROb3RpZmljYXRpb25VUkwiOiJ0aHJlZURTTWV0aG9kTm90aWZpY2F0aW9uVVJMIn0″>

</form>

The ACS will interact with the Cardholder browser via the HTML iframe and then store the applicable values with the 3-D Secure Server Transaction ID for use when the subsequent authentication message is received containing the same 3-D Secure Server Transaction ID.

Netcetera 3DS Web SDK: You may use the operations init3DSMethod or createIframeAndInit3DSMethod at your discreation from the nca3DSWebSDK in order to iniatiate the 3-D Secure Method. Please refer to the Integration Manual at https://mpi.netcetera.com/3dsserver/doc/current/integration.html#Web_Service_API.

Once the 3-D Secure Method is concluded the ACS will instruct the cardholder browser through the iFrame response document to submit threeDSMethodData as a hidden form field to the 3-D Secure Method Notification URL.

3.5.4 ACS Response Document

<!DOCTYPE html>

<html lang=”en”>

<head>

<meta charset=”UTF-8″/>

<title>Identifying…</title>

</head>

<body>

<script>

var tdsMethodNotificationValue = ‘eyJ0aHJlZURTU2VydmVyVHJhbnNJRCI6ImUxYzFlYmViLTc0ZTgtNDNiMi1iMzg1LTJlNjdkMWFhY2ZhMiJ9’;

var form = document.createElement(“form”);

form.setAttribute(“method”, “post”);

form.setAttribute(“action”, “notification URL”);

addParameter(form, “threeDSMethodData”, tdsMethodNotificationValue);

document.body.appendChild(form);

form.submit();

function addParameter(form, key, value) {

var hiddenField = document.createElement(“input”);

hiddenField.setAttribute(“type”, “hidden”);

hiddenField.setAttribute(“name”, key);

hiddenField.setAttribute(“value”, value);

form.appendChild(hiddenField);

}

</script>

</body>

</html>

3.5.5 3-D Secure Method Notification Form

<form name=”frm” method=”POST” action=”3DS Method Notification URL”>

<input type=”hidden” name=”threeDSMethodData” value=”eyJ0aHJlZURTU2VydmVyVHJhbnNJRCI6ImUxYzFlYmViLTc0ZTgtNDNiMi1iMzg1LTJlNjdkMWFhY2ZhMiJ9″>

</form>

Please note that the threeDSMethodNotificationURL as embedded in the Base64 encoded threeDSMethodData value points to the 1cs Online Payment System and must not be modified. The merchant notification is delivered to the URLNotify as provided in the original request or as configured for the MerchantID in the 1cs OPS.

3.6 Authentication

If 3-D Secure Method is supported by the issuer ACS and was invoked by the merchant 1cs OPS will automatically continue with the authentication request once the 3-D Secure Method has completed (i.e. 3-D Secure Method Notification).

The authentication result will be transferred via HTTP POST to the URLNotify . It may indicate that the Cardholder has been authenticated, or that further cardholder interaction (i.e. challenge) is required to complete the authentication.

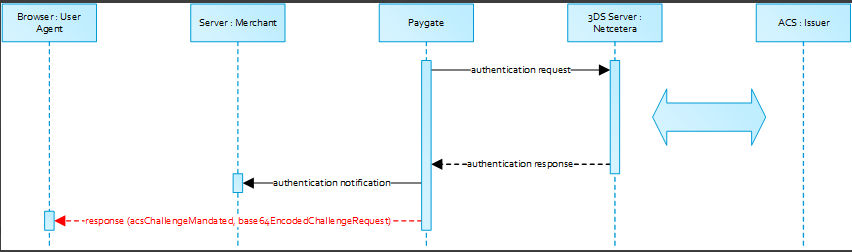

In case a cardholder challenge is deemed necessary The 1cs Online Payment system will transfer a JSON object within the body of HTTP browser response with the elements acsChallengeMandated , challengeRequest , base64EncodedChallengeRequest and acsURL . Otherwise, in a frictionless flow, the 1cs OPS will automatically continue and respond to the cardholder browser once the authorization completed.

3.6.1 Cardholder Challenge: Browser Response

3.6.2 Browser Challenge Response

Data Elements

| Key | Format | CND | Description |

| acsChallengeMandated | boolean | M | Indication of whether a challenge is required for the transaction to be authorised due to local/regional mandates or other variable: true → Challenge is mandated by local/regional regulations false → Challenge is not mandated by local/regional regulations, but is deemed necessary by the ACS |

| challengeRequest | object | M | Challenge request object |

| base64EncodedChallengeRequest | string | M | Base64-encoded Challenge Request object |

| acsURL | string | M | Fully qualified URL of the ACS to be used to post the Challenge Request |

Schema: Browser Challenge Response

{

“$schema”: “http://json-schema.org/draft-07/schema#“,

“type”: “object”,

“properties”: {

“acsChallengeMandated”: {“type”: “boolean”},

“challengeRequest”: {“type”: “object”},

“base64EncodedChallengeRequest”: {“type”: “string”},

“acsURL”: {“type”: “string”}

},

“required”: [“acsChallengeMandated”, “challengeRequest”, “base64EncodedChallengeRequest”, “acsURL”],

“additionalProperties”: false

}

Sample: Browser Challenge Response

{

“acsChallengeMandated”: false,

“challengeRequest”: {

“threeDSServerTransID”: “8a880dc0-d2d2-4067-bcb1-b08d1690b26e”,

“acsTransID”: “d7c1ee99-9478-44a6-b1f2-391e29c6b340”,

“messageType”: “CReq”,

“messageVersion”: “2.1.0”,

“challengeWindowSize”: “01”,

“messageExtension”: [

{

“name”: “emvcomsgextInChallenge”,

“id”: “tc8Qtm465Ln1FX0nZprA”,

“criticalityIndicator”: false,

“data”: “messageExtensionDataInChallenge”

}

]

},

“base64EncodedChallengeRequest”: “base64-encoded-challenge-request”,

“acsURL”: “acsURL-to-post-challenge-request”

}

3.6.3 Authentication Notification

The data elements of the authentication notification are listed in the table below.

| Key | Format | CND | Description |

| MID | ans..30 | M | MerchantID, assigned by the 1cs Online Payment System |

| PayID | an32 | M | ID assigned by the 1cs OPS for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| Code | n8 | M | Error code according to Paygate Response Codes (A4 Error codes) |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: HMAC Authentication (Request) HMAC Authentication (Notify) |

| AuthenticationResponse | JSON | M | Response object in return of the authentication request with the ACS |

3.6.4 Browser Challenge

If a challenge is deemed necessary (see challengeRequest) the browser challenge will occur within the cardholder browser. To create a challenge it is required to post the value base64EncodedChallengeRequest via an HTML iframe to the ACS URL.

Challenge Request

<form name=”challengeRequestForm” method=”post” action=”acsChallengeURL”>

<input type=”hidden” name=”creq” value=”ewogICAgInRocmVlRFNTZXJ2ZXJUcmFuc0lEIjogIjhhODgwZGMwLWQyZDItNDA2Ny1iY2IxLWIwOGQxNjkwYjI2ZSIsCiAgICAiYWNzVHJhbnNJRCI6ICJkN2MxZWU5OS05NDc4LTQ0YTYtYjFmMi0zOTFlMjljNmIzNDAiLAogICAgIm1lc3NhZ2VUeXBlIjogIkNSZXEiLAogICAgIm1lc3NhZ2VWZXJzaW9uIjogIjIuMS4wIiwKICAgICJjaGFsbGVuZ2VXaW5kb3dTaXplIjogIjAxIiwKICAgICJtZXNzYWdlRXh0ZW5zaW9uIjogWwoJCXsKCQkJIm5hbWUiOiAiZW12Y29tc2dleHRJbkNoYWxsZW5nZSIsCgkJCSJpZCI6ICJ0YzhRdG00NjVMbjFGWDBuWnByQSIsCgkJCSJjcml0aWNhbGl0eUluZGljYXRvciI6IGZhbHNlLAoJCQkiZGF0YSI6ICJtZXNzYWdlRXh0ZW5zaW9uRGF0YUluQ2hhbGxlbmdlIgoJCX0KICAgIF0KfQ==”>

</form>

You may use the operations init3DSChallengeRequest or createIFrameAndInit3DSChallengeRequest from the nca3DSWebSDK in order submit the challenge message through the cardholder browser.

Init 3-D Secure Challenge Request – Example

<!DOCTYPE html>

<html lang=”en”>

<head>

<meta charset=”UTF-8″>

<script src=”nca-3ds-web-sdk.js” type=”text/javascript”></script>

<title>Init 3-D Secure Challenge Request – Example</title>

</head>

<body>

<!– This example will show how to initiate Challenge Reqeuests for different window sizes. –>

<div id=”frameContainer01″></div>

<div id=”frameContainer02″></div>

<div id=”frameContainer03″></div>

<div id=”frameContainer04″></div>

<div id=”frameContainer05″></div>

<iframe id=”iframeContainerFull” name=”iframeContainerFull” width=”100%” height=”100%”></iframe>

<script type=”text/javascript”>

// Load all containers

iFrameContainerFull = document.getElementById(‘iframeContainerFull’);

container01 = document.getElementById(‘frameContainer01’);

container02 = document.getElementById(‘frameContainer02’);

container03 = document.getElementById(‘frameContainer03’);

container04 = document.getElementById(‘frameContainer04’);

container05 = document.getElementById(‘frameContainer05’);

// nca3DSWebSDK.init3DSChallengeRequest(acsUrl, creqData, container);

nca3DSWebSDK.init3DSChallengeRequest(‘http://example.com‘, ‘base64-encoded-challenge-request’, iFrameContainerFull);

// nca3DSWebSDK.createIFrameAndInit3DSChallengeRequest(acsUrl, creqData, challengeWindowSize, frameName, rootContainer, callbackWhenLoaded);

nca3DSWebSDK.createIFrameAndInit3DSChallengeRequest(‘http://example.com‘, ‘base64-encoded-challenge-request’, ’01’, ‘threeDSCReq01’, container01);

nca3DSWebSDK.createIFrameAndInit3DSChallengeRequest(‘http://example.com‘, ‘base64-encoded-challenge-request’, ’02’, ‘threeDSCReq02’, container02);

nca3DSWebSDK.createIFrameAndInit3DSChallengeRequest(‘http://example.com‘, ‘base64-encoded-challenge-request’, ’03’, ‘threeDSCReq03’, container03);

nca3DSWebSDK.createIFrameAndInit3DSChallengeRequest(‘http://example.com‘, ‘base64-encoded-challenge-request’, ’04’, ‘threeDSCReq04’, container04);

nca3DSWebSDK.createIFrameAndInit3DSChallengeRequest(‘http://example.com‘, ‘base64-encoded-challenge-request’, ’05’, ‘threeDSCReq05’, container05, () => {

console.log(‘Iframe loaded, form created and submitted’);

});

</script>

</body>

</html>

Once the cardholder challenge is completed, was cancelled or timed out the ACS will instruct the browser to post the results to the notfication URL as specified in the challenge request and to send a Result Request (RReq) via the Directory Server to the 3-D Secure Server.

Please note that the notification URL submited in the challenge request points to the 1cs Online Payment System and must not be changed.

3.7 Authorization

After successful cardholder authentication or proof of attempted authentication/verification is provided the 1cs Online Payment System will automatically continue with the payment authorization.

In case the cardholder authentication was not successful or proof proof of attempted authentication/verification can not be provided the 1cs Online Payment System will not continue with an authorization request.

In both cases the 1cs OPS will deliver a notification with the authentication result to the merchant specified URLNotify with the data elements as listed in the table below.

3.7.1 Payment Notification

| Parameter | Format | CND | Beschreibung |

| MID | ans..30 | M | MerchantID, assigned by the 1cs Online Payment System |